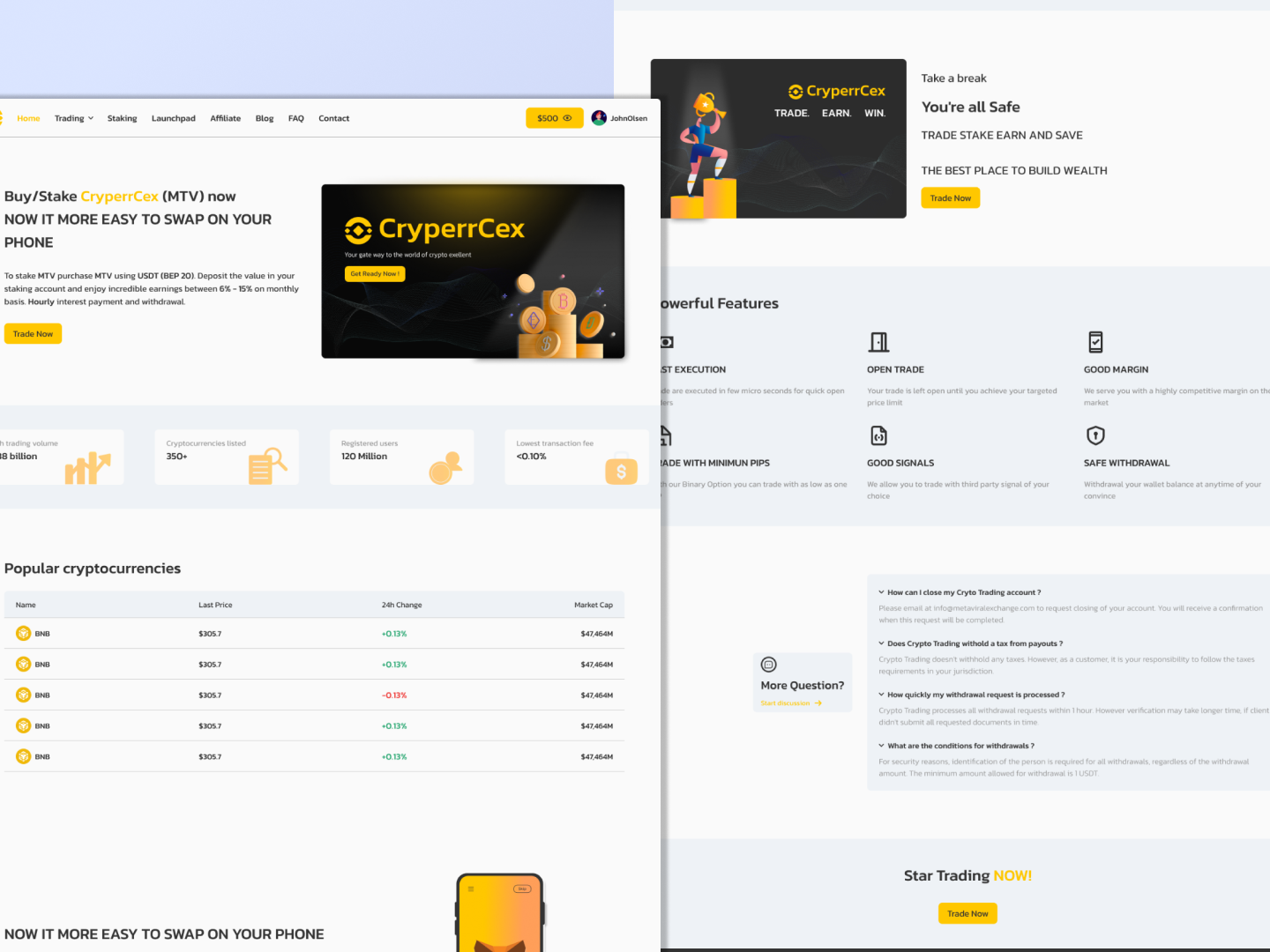

- Features

-

More Features Coming Soon

-

- Services

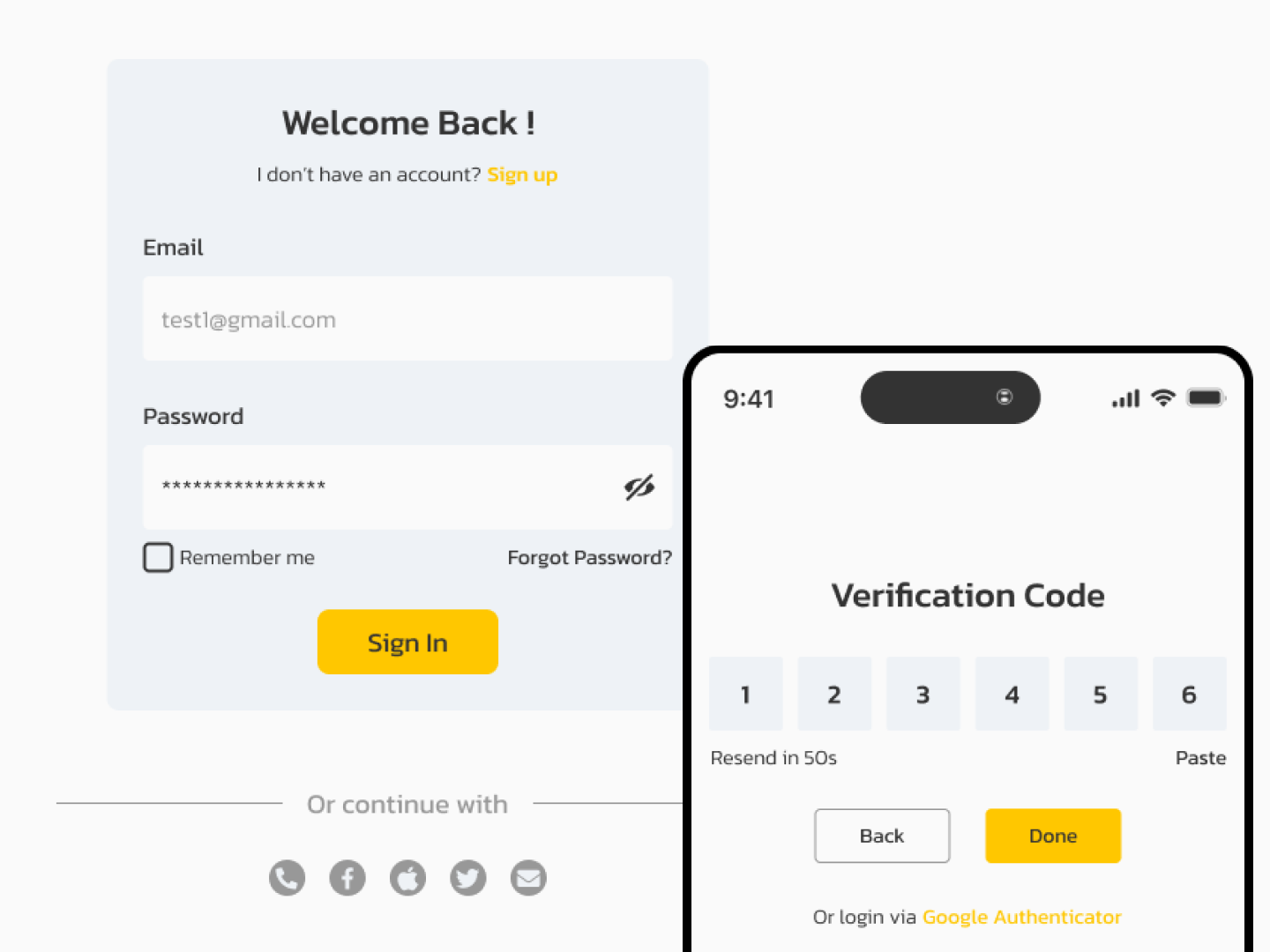

- Documentation

- Contact Us

In this guide, we’ll explain the functional differences between accounting and bookkeeping, as well as the differences between the roles of bookkeepers and accountants. It can run a tad behind sometimes but when the reports are finished they are very informative and let me see where I need to cut spending, increase revenue. As a small business owner I already take no too many roles and Bench eases that burden.

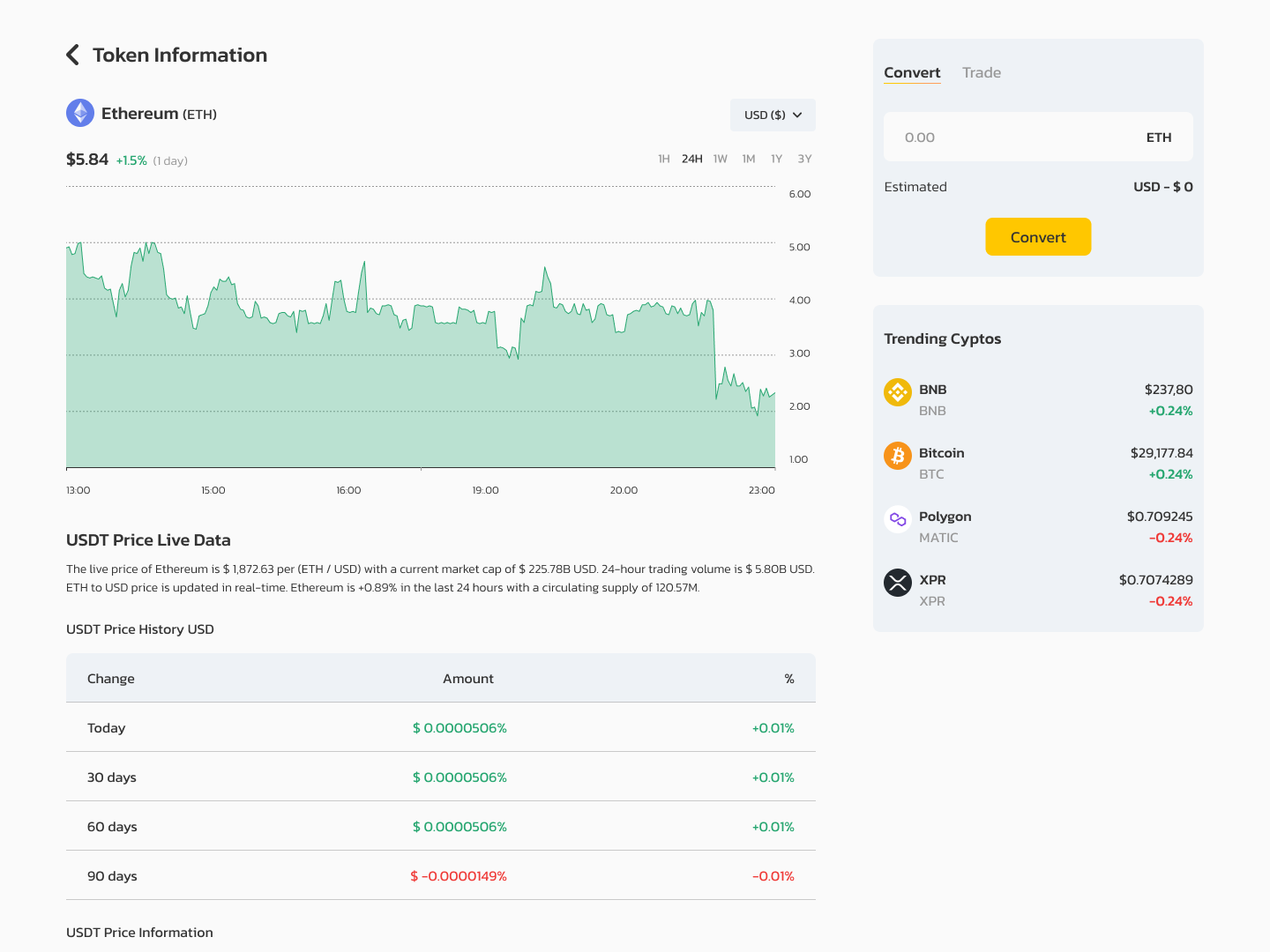

Debits VS Credits: A Simple, Visual Guide

- Everything you need to know about switching from DIY to done-for-you bookkeeping.

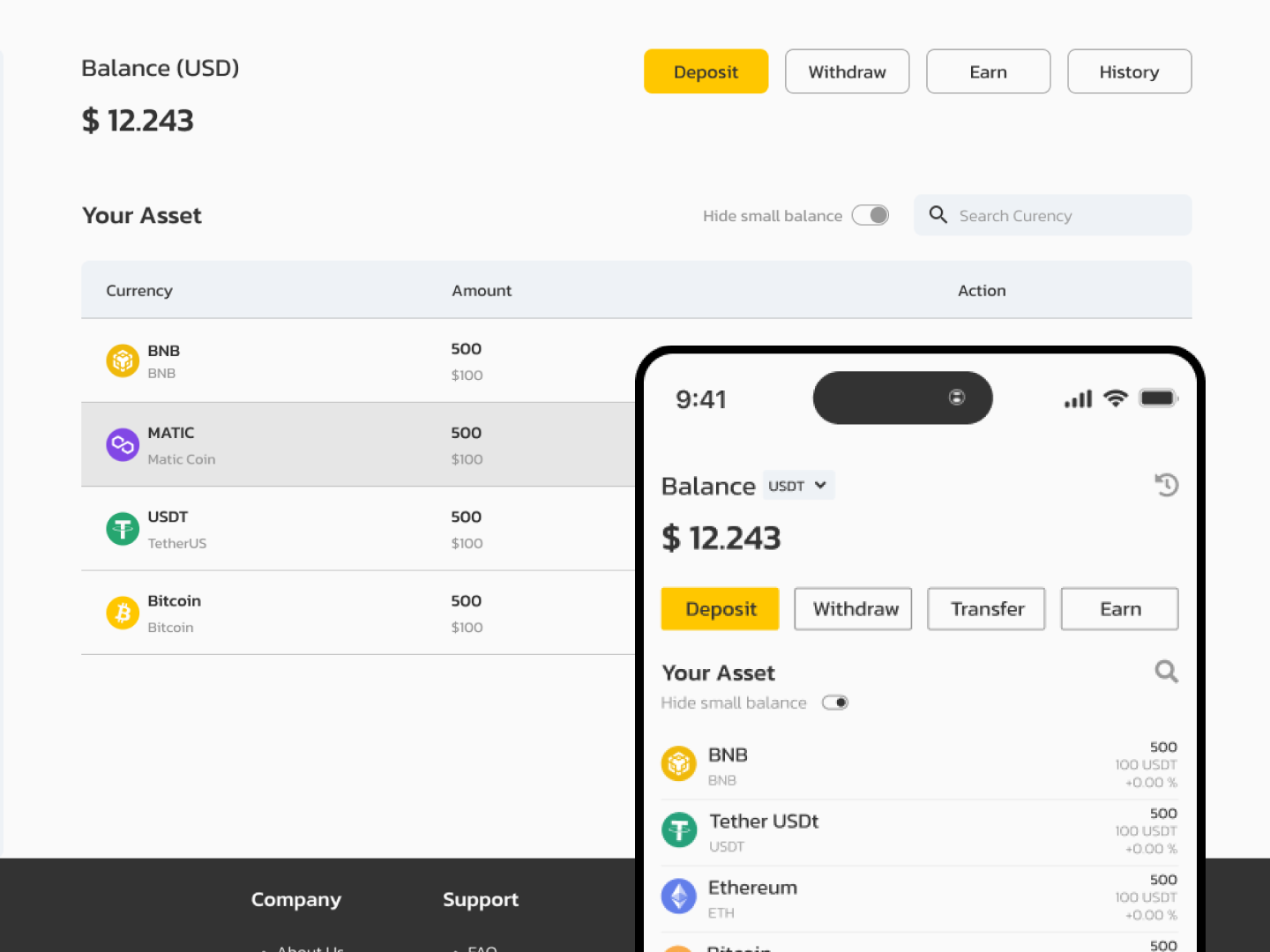

- It eliminates the need for manual uploads, with your data appearing in your account instantly.

- Before we get started on DIY bookkeeping, download our Income Statement Template.

- The info in the copy of the income statement template you downloaded is only there as a placeholder.

Fortunately, you can answer this question by calculating your break-even point. These are the essential financial terms every small business owner needs to understand. Learn the right way to pay yourself, depending on your business structure. An in-depth guide to setting up the accounting basics for your law firm. Nothing feels better than that first online sale, but as your business grows, so will your admin. The accounts receivable turnover ratio is a simple formula to calculate how quickly your clients pay.

Ditch the tax headaches

- They use QuickBooks Desktop or Online (tried and true), you have 24/7 access to your reports on their decor cloud or app, you have a dedicated bookkeeper and a team of experts behind them.

- Book a call with a client sales representative who will be happy to answer any questions you have about Bench Tax and confirm that it’s a good fit for your business.

- Our bookkeeping team will verify the documents you’ve previously uploaded and match them to the corresponding requests, so you won’t be asked for the same document again.

- We are delighted to hear about your positive experience with Bench Accounting.

- With access to real-time reporting, Bench makes it easier for businesses to track their financial performance accurately at any given time.

- Our Bench Tax Advisors are licensed tax professionals that facilitate the preparation of your income tax return, review it with you and then get it filed with the IRS and your state.

Read our review of Sage’s accounting assets = liabilities + equity services to see if it is the right solution for your business. “We regret to inform you that as of December 27, 2024, the Bench platform will no longer be accessible,” Bench wrote in its service closure notice. “We know this news is abrupt and may cause disruption, so we’re committed to helping Bench customers navigate through the transition. It’s best for freelancers or small businesses with relatively straightforward financials.

- The IRS lays out which business transactions require supporting documents on their website.

- You didn’t become a small business owner to also moonlight as a monthly bookkeeper.

- Our mission is to help every business owner thrive, by providing financial insight and peace of mind in one seamless platform.

- The platform is best for freelancers and small businesses with basic bookkeeping needs, such as providing cash-basis financial statements for tax return preparation.

- We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

- That means you’ll never lose access to your data within our platform.

Discover Bench’s online bookkeeping advantage. We do the heavy lifting so you don’t have to.

We’re still on hand to support you, and can give recommendations based on your unique business needs. Bookkeeping is the process of recording daily transactions in a consistent way, and is a key component to building a financially successful business. Bookkeepers take care of the day-to-day financials, like posting credits and debits, maintaining the general ledger, and completing payroll. If you’re switching from QuickBooks, we’ll work from your closing balances to virtual accountant do your bookkeeping going forward. If you’re not sure whether your closing balances are accurate, we recommend chatting with one of our Onboarding Specialists about Catch Up bookkeeping. We use our own proprietary software to complete your books.

We take care of your income tax filing and provide you with unlimited tax advisory consultations throughout the year. This service adds a dedicated tax coordinator, a tax advisor, and a tax preparer bench accounting login to your bookkeeping team. Once we have everything set up, we’ll complete a month of your bookkeeping. Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books. The end result is a set of accurate financial statements—an income statement and a balance sheet. The platform is best for freelancers and small businesses with basic bookkeeping needs, such as providing cash-basis financial statements for tax return preparation.